Islamic Finance Institute:

Institute of Islamic Banking and Finance is globally accredited, solidifying its position as a premier centre for Islamic finance education since the year 2005. The Institute’s commitment to excellence in the realm of Islamic finance qualification has been acknowledged by international bodies. The Islamic finance institute has partnerships with a myriad of academic and professional entities all around the world. Our meticulously designed Islamic finance education programs are developed by industry-leading Shariah scholars and practitioners and empower individuals to become industry experts. Furthermore, they help organizations establish robust Islamic financial systems, setting new standards for excellence in the field.

Our Expertise:

Why Choose AIMS?

Islamic Finance Qualifications

Our programs are designed by renowned scholars, ensuring the curriculum remains up-to-date with the latest trends in the industry. By successfully completing these programs, qualified professionals can assume prominent roles in the establishment and management of Islamic financial institutions on a global scale.

Key Features

Why should you consider Islamic Finance as a career?

The Thomson Reuters report indicates a significant expansion within the Islamic finance sector, marking an 11% year-on-year growth over the last ten years, culminating in a towering $4.5 trillion in assets by 2023. With projections set at a 17% growth rate moving forward, the sector, particularly the Islamic banking domain in the Middle East, is a formidable employer, generating upward of 140,000 positions. This industry’s upsurge underscores a heightened need for experts proficient in the tenets of Islamic finance, a niche that the AIMS Institute of Islamic Banking and Finance is uniquely positioned to fill by equipping professionals with the necessary expertise.

What explains the recent surge in the demand for Islamic banking and finance?

The increasing demand for Islamic banking and finance can be attributed to several factors, including the ethical nature of its practices, which are built on the principles of risk sharing, prohibition of interest, and promoting economic justice.

What qualifications does the Centre for Islamic finance offer?

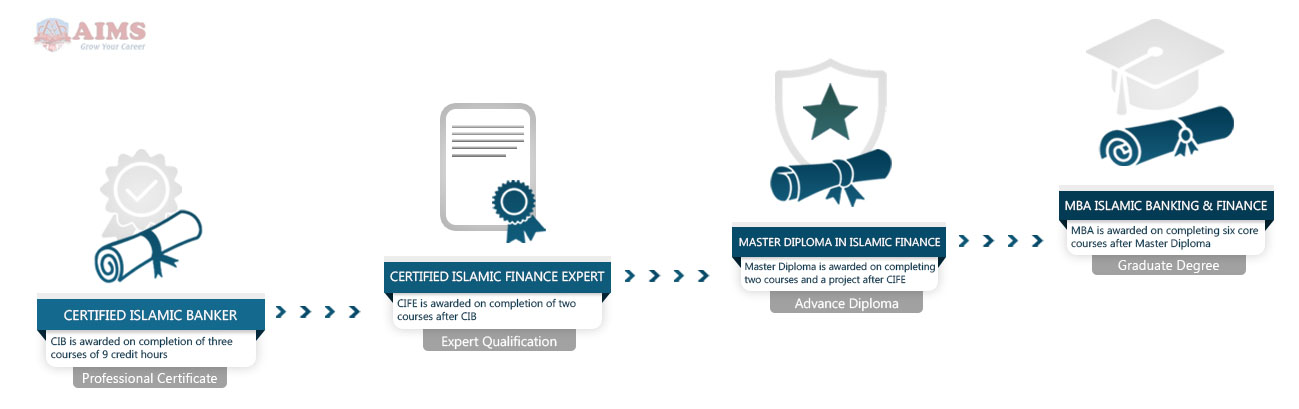

AIMS Institute of Islamic Finance and Insurance offers a variety of specialized programs tailored to the diverse needs of its students.

- For those at the beginning of their career journey in Islamic finance, the institute offers Islamic finance certification and an Islamic banking & finance diploma in Islamic Banking and Finance. These courses cover the principles and practices of Islamic finance and banking, providing a solid base for further study or entry into the workforce.

- For professionals seeking to enhance their knowledge and skills, the institute provides an MBA in Islamic Banking and Finance. This program delves deeper into the complexity of Islamic financial systems, exploring advanced concepts and strategies.

- Lastly, for individuals interested in conducting research in this field, the institute offers a PhD Doctorate in Islamic Finance. This program is designed to foster a deeper understanding and insight into Islamic financial systems and to contribute to the body of knowledge in this field through original research.

How does AIMS Islamic Finance Institute prepare students for the global marketplace?

The Islamic Finance Institute equips students with the skills and knowledge to navigate the complex world of Islamic finance. AIMS’ interactive and flexible online learning system enables students across the globe to gain critical knowledge and skills in Islamic finance from the comfort of their homes. Our adherence to high-quality educational and industry standards enables our graduates to effectively contribute to and innovate within the Islamic finance industry.

How can the AIMS Institute of Islamic Banking and Finance help you succeed in your career?

AIMS’ job-oriented approach ensures that students are equipped with a practical understanding of Islamic banking principles and their applications in real-world scenarios. The curriculum includes real case studies, projects, and engagement with industry practitioners. As a result, students gain both theoretical knowledge and practical skills, significantly boosting their employability and success in the Islamic banking and finance sector.

What sets AIMS apart from other Islamic finance institutes?

AIMS Institute of Islamic Banking and Finance is recognized and registered with the UK Register of Learning Providers (UKRLP), ensuring that our programs meet stringent educational standards. Courses are also accredited for Continuing Professional Development (CPD). Moreover, our curriculum is guided by the AAOIFI Shariah Standards. Our commitment to research also sets us apart, as we continuously contribute to the development and innovation of Islamic financial practices.

Our Student Say!

“I had a great time studying at AIMS Institute of Islamic Banking and Finance. I first completed my CIFE online with the help of interactive lectures, study manuals, and other academic resources. The study contents are all, very well-organized. The Islamic finance training contents designed by AIMS are excellent and they give the true way of implementing the Islamic banking and financial system in today’s world. The views expressed in the program, are under the views of scholars, like Mufti Taqi Usmani, and they are AAOIFI Shariah compliant. I would strongly recommend this centre for Islamic finance to everyone.”

Nida Khan, Manager Finance

GUB, Luxembourg.