MBA in Islamic Finance Degree

Islamic finance is a rapidly expanding industry fueled by its ethical foundation and interest-free nature, at an annual rate of 10-12%. It is leading to a surge in job opportunities, with the sector expected to create over 1.5 Million jobs by 2025. In response to this growing demand, AIMS has meticulously designed the MBA in Islamic finance degree. This globally recognized and UK-accredited MBA in Islamic banking and finance online degree program is designed by prominent Islamic finance scholars and practitioners, and it adheres to the Shariah standards set by AAOIFI. The Masters in Islamic Finance adopts a self-paced learning system. This flexible approach allows students to study at their own pace, accommodating their various personal and professional commitments.

Program Objectives !

MBA Islamic Finance Degree: A Quick Review

| Mode of Study: | Online & Self-paced learning. |

| Average Duration: | 12 months. |

| Validity: | Two years. |

| Study Resources: | Online Interactive lectures. Comprehensive Study manuals. 24/7 faculty support from Shariah experts. Islamic Finance e-Library. Online Assignments. |

| Courses to Study: | 13 courses & a Project in Islamic finance. |

| Study Requirements: | 10 – 12 hours of study in a week. |

| Final Assessment: | Assignments [35%], final exam [55%] and project [10%]. |

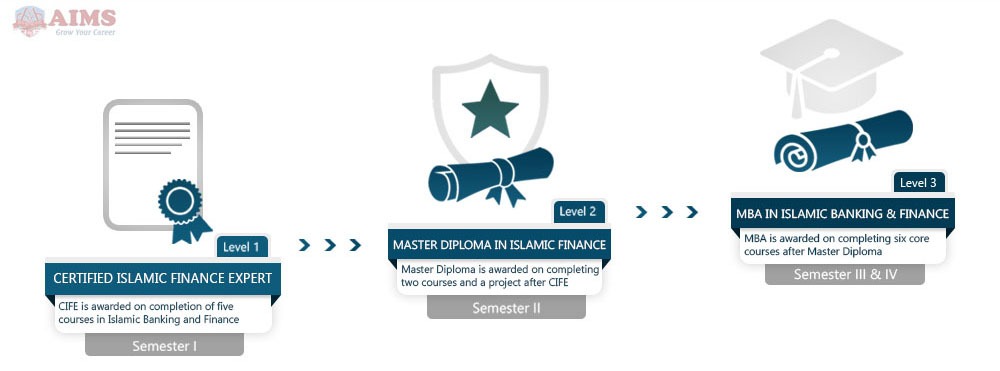

| Bonus Awards: | CIB and CIFE certifications on completion of Semester-I, and, CTP and Master Diploma on completion of Semester II. |

How to Achieve Masters in Islamic Finance?

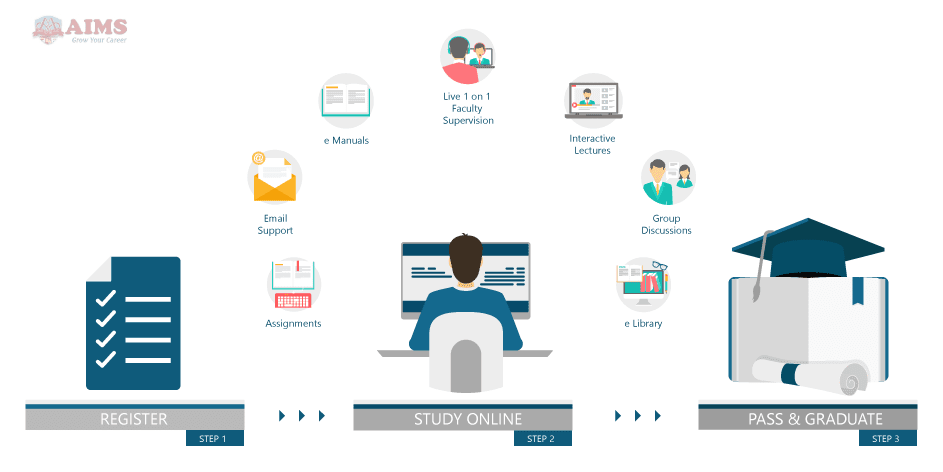

If you decide to pursue an MBA in Islamic Banking and Finance from AIMS, you’ll attend flexible online classes. Once you’re enrolled, you’ll be able to make a personalized study plan. It is simple and convenient to study through our e-learning program. Professionals with busy schedules may choose to take courses at times that suit them. The educational resources include interactive and illustrated lectures, extensive online manuals, and an Islamic finance e-library. You may submit your online assignments whenever you have time, and you may take the online test when it is convenient for you.

Structure of MBA Islamic Finance Program

The MBA in Islamic Banking and Finance consists of six core courses in business management (18 credit hours), seven concentration courses in Islamic banking and finance (21 credit hours), and a real-world project (6 credit hours).

Accreditation

Our online MBA in Islamic Finance program is Accredited by CPD and Registered with UKRLP in the UK. We adhere to the prestigious guidelines of the Ofqual Regulated Qualifications Framework (RQF), ensuring a Level-7 Masters Degree. Plus, we follow the stringent Shariah Standards set by AAOIFI.

Our Student Say!

“The MBA in Islamic Banking and Finance degree program provided me with the knowledge I needed to become an expert in this field. The course material is well put together. The interactive lectures and other study resources are excellent. Assignments are also valuable, and every subject is treated in detail. It was a sensible decision to earn an Islamic finance degree from AIMS.”

Tovah Mutukura, Finance Advisor,

Kubota, Australia.

Have Question?

Key Features of Our MBA in Islamic Banking

Why opt for an online MBA in Islamic Banking and Finance with AIMS?

Choosing to pursue your MBA in Islamic Banking and Finance with AIMS has distinct advantages.

Global Recognition and Accreditation:

The MBA in Islamic Finance from AIMS UK enjoys extensive global recognition and accreditation. This not only adds value to the degree but also provides graduates with international mobility in their careers.

Transfer of Credits for Higher Studies:

Students who wish to pursue further studies have the advantage of transferring their credits. This feature of the MBA Islamic Banking and Finance program allows for continuous learning and progression in the field.

Practical Exposure during Studies:

AIMS believes in providing its students with practical exposure and real-world applications of their studies. This approach ensures students in the MBA in Islamic Banking and Finance program gain meaningful experience, preparing them for the challenges they may encounter in their professional lives.

Flexible Online Learning:

The program is delivered via a flexible online learning platform, allowing students to balance their studies with other commitments. This feature makes online Masters in Islamic finance a highly convenient option for busy professionals.

Comprehensive Curriculum:

The curriculum covers all the essential fields of Islamic banking and finance, ensuring students acquire a comprehensive understanding of the industry.

Expert Faculty:

The faculty comprises experts in the field of Islamic banking and finance, providing students with an opportunity to learn from those with a wealth of practical and academic experience.

Interactive Learning Experience:

The program employs a blend of teaching methodologies to create an engaging and interactive online learning environment.

Career Support:

AIMS also provides career support services, assisting students and graduates in their job search and offering guidance on career paths in the Islamic finance industry.

Research Opportunities:

The MBA in Islamic banking and finance creates opportunities for students to conduct original research in Islamic banking and finance, contributing to the growth of the field.

What are the crucial areas that the curriculum of the MBA Islamic finance encompasses?

The curriculum of the MBA in Islamic finance is comprehensive and multi-faceted, designed to cover all essential areas pertinent to this field. At the core, the program includes an in-depth study of the Islamic economic system and Islamic microeconomics, providing a solid foundation for understanding the principles that govern Islamic financial instruments and the Islamic Insurance system (Takaful). Subsequent modules delve deeper into the specifics of Islamic commercial banking and Islamic investment banking, both crucial sectors within the Islamic finance industry.

In addition to Islamic finance-specific subjects, the program also integrates core business modules, such as business management, marketing management, human resource management, organizational behavior, and financial management. Lastly, students apply their knowledge in real-world scenarios. This well-rounded approach ensures that our MBA in Islamic Finance graduates are well-equipped to take on challenging roles in the Islamic finance industry. Explore our comprehensive MBA curriculum.