History of Islamic Banking:

Islamic banking and finance have a rich history that dates back to the early days of Islam. It is believed that the concept of interest-free transactions was first introduced by Prophet Muhammad (peace be upon him) in the 7th century. The history of Islamic banking and finance is rooted in principles that have been refined through the ages, reflecting the evolution of economic systems and societal transformations. One of the earliest known examples of Islamic banking is the establishment of a “Hawala” system in 9th century Baghdad. This was a money transfer system based on trust, where merchants would deposit their money with a trusted agent who would then transfer it to a recipient at another location.

Development of Islamic Banking:

1. Establishment of the First Islamic Bank:

The history of Islamic banking can be traced back to the 1960s, with the establishment of the Mit Ghamr Savings Bank in Egypt in 1963, by Dr. Ahmed El Najjar. This revolutionary institution was conceived to provide banking services following the principles of Shariah law.

The Mit Ghamr Savings Bank introduced an innovative banking model based on cooperation, partnership, and profit/loss sharing. The bank did not pay interest to its depositors but instead offered them a share in the bank’s profits.

2. Services Offered by the First Islamic Bank:

The Mit Ghamr Savings Bank, as the pioneer in Islamic banking, offered a variety of services that mirrored Islamic finance’s core principles:

A. SAVING ACCOUNT:

These were structured in a way that complied with Islamic law. Instead of earning interest, depositors shared in the bank’s profits.

B. BUSINESS LOAN:

Again, these aligned with Islamic principles by promoting a profit-sharing approach. Entrepreneurs would secure financing from the bank and then share a portion of their profits, fostering a sense of partnership and mutual benefit.

C. INVESTMENT ACCOUNTS:

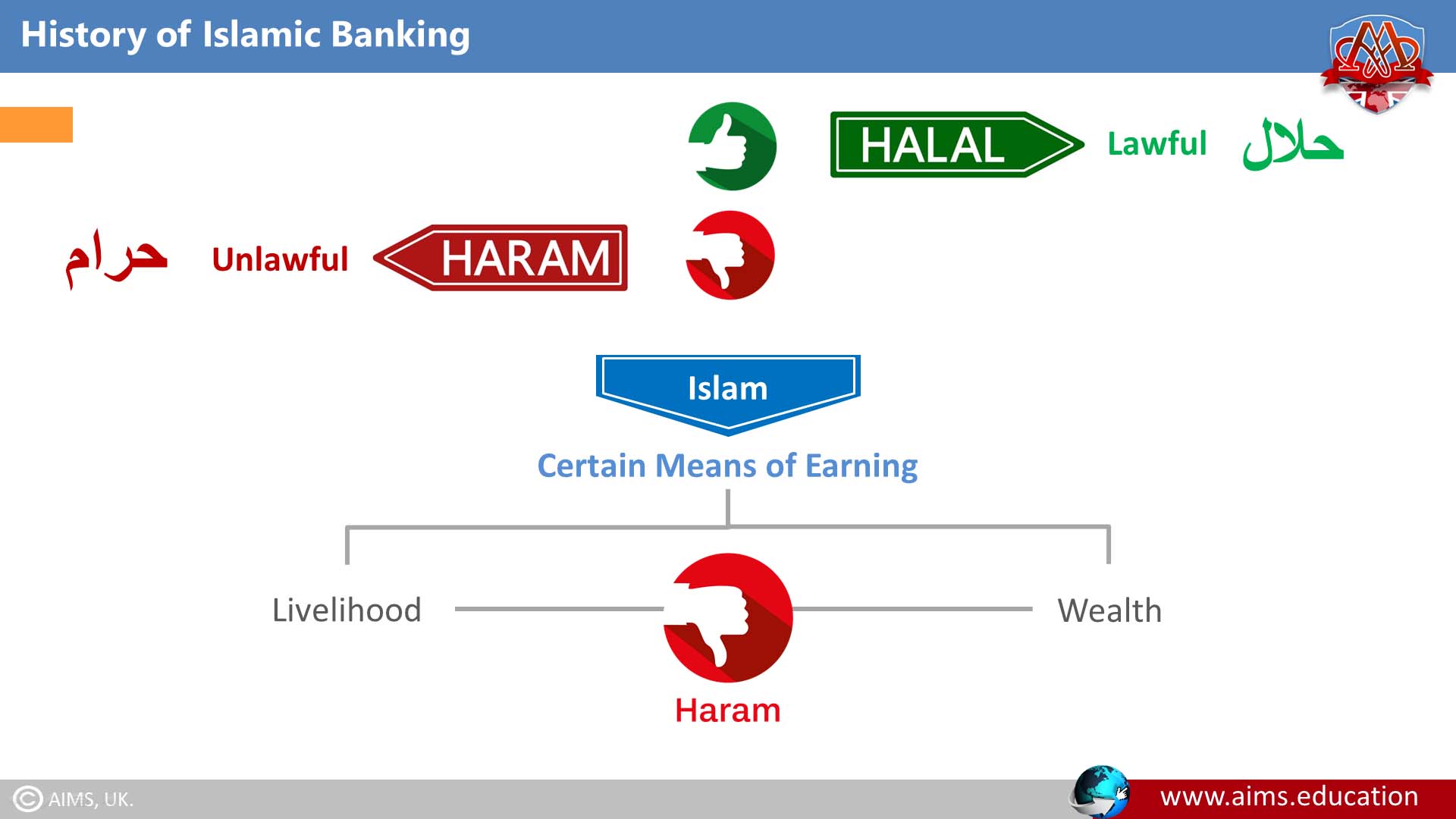

The institution further provided avenues for investment that were in strict compliance with Shariah principles, echoing the storied history of Islamic banking and its enduring adherence to ethical financial practices. This meant investment funds were allocated only to halal (permissible) ventures, avoiding sectors or industries deemed haram (forbidden), such as alcohol, tobacco, and gambling.

D. ZAKAT SERVICES:

In line with the Islamic pillar of Zakat, the bank provided services to calculate and disburse Zakat, further ingraining Islamic principles in its operations.

3. Global Expansion of Islamic Banking:

The successful implementation of the Islamic banking model by Mit Ghamr Savings Bank ignited interest in the concept both nationally and internationally. This interest precipitated a wave of establishment of Islamic banks in the late 20th century, marking a significant development in the history of Islamic banking.

The Dubai Islamic Bank, established in 1975, was the next major Islamic bank to emerge. Following the model of its predecessor, the bank adhered to Shariah law principles while offering a comprehensive array of banking services. Its establishment marked a crucial turning point in the development of Islamic banking, positioning Dubai as a vital hub for Islamic finance.

4. The Emergence of Islamic Development Bank: A Milestone in the History of Islamic Banking:

Just two years after the debut of the Dubai Islamic Bank, the Islamic Development Bank was launched in Saudi Arabia in 1977. Its unique mission was not just to provide banking services per Islamic law, but also to:

- Foster the development of Islamic economics; and;

- Social progress of member countries and Muslim communities around the world.

This Islamic Development Bank played a pivotal role in shaping the evolution of Islamic banking by advocating for the economic empowerment of Muslim populations.

5. The 1980s: A Decade of Rapid Expansion in the History of Islamic Banking:

The 1980s witnessed a surge in the establishment of Islamic banks across multiple regions. In Malaysia, the first Islamic bank, Bank Islam Malaysia Berhad, was established in 1983. It is paving the way for the country’s robust Islamic finance industry today. In the decades that followed, Islamic banking continued to gain momentum globally. Today, it has established a strong presence in over 75 countries, reflecting the widespread acceptance and growth of this alternative banking model with a rich history of Islamic banking.

Evolution of Islamic Banking

1. Influence of Islamic Economics on the Development of Islamic Banking:

Numerous teachings within Islam extend to and emphasize the significance of economic matters. Indeed, one of the quintessential inquiries Muslims will put forth on Judgement Day revolves around their means of wealth acquisition and its subsequent expenditure. Compliance with ‘Halal’ or Islamic Law-approved means is a prerequisite for both earning and spending.

As the Islamic empire began to expand, early Islamic scholars found it essential to explore ‘Halal’ strategies to generate state revenue, while concurrently addressing the state’s responsibility towards public expenditure. Consequently, the field of public finance evolved into a comprehensive and advanced discipline within Islamic academia. As a result, the origins and evolution of Islamic banking can be traced back to these initial Islamic doctrines, which held significant sway in shaping this financial system’s foundational principles.

2. A Brief Insight Into the Islamic Banking History:

Since the emergence of Islam as a new universal religion about 1400 years ago, it has been practiced by more than 2 billion people across the world. In many respects, Islamic Law goes beyond conventional norms for other religions because its practices must align with certain rules set out in the Quran. These rules are called Sharia or ‘God’s Law’ and form part of the framework for social conduct that Muslims must follow in their everyday lives.

3. Modern History of Islamic Finance:

The history of Islamic banking can be traced back to Egypt in 1963 with the establishment of the Mit Ghamr Savings Bank. It was modeled after traditional savings and loan associations (known as “waqf”) and offered Shariah-Compliant interest-free loans to its members. However, it was not until the 1970s that Islamic banking gained global recognition with the establishment of the Islamic Development Bank (IDB) and Dubai Islamic Bank.

4. Development of Islamic Banking and Finance:

The 1970s saw a rapid growth in the demand for Shariah-compliant financial products, which led to the establishment of more Islamic banks and financial institutions around the world. In 1975, Malaysia etched its name in the annals of the history of Islamic finance by establishing itself as the pioneering nation to provide a detailed regulatory system for the governance of Islamic banking and fiscal activities. This was followed by other countries such as Bahrain, Kuwait, and Saudi Arabia. The 1980s saw the introduction of new products and services in Islamic banking, such as Mudarabah (profit-sharing) and Musharakah (partnership). These allowed for more diverse investment opportunities and helped attract a wider range of customers.

5. Evolution of Islamic Banking:

In the 1990s, Islamic banking and finance continued to evolve with the establishment of the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) in 1991. This organization aimed to standardize and regulate the industry, ensuring that all financial products and services complied with Shariah principles. The 21st century has seen a further expansion of Islamic banking and finance, with more countries around the world offering Shariah-compliant financial services. Today, over 300 Islamic banks are operating in more than 60 countries, with total assets estimated at over $4 trillion. This growth not only reflects the rising demand for Sharia-compliant financial services but also marks a noteworthy chapter in the history of Islamic banking.

6. First Islamic Bank in the World:

The history of Islamic banking is both rich and intriguing. The first Islamic bank in the world was founded in Egypt in 1963, called Mit Ghamr Savings Bank. However, it wasn’t until 1975 that the Dubai Islamic Bank became the first modern Islamic bank to be established, offering a full range of Shariah-compliant banking and financial services. The principles of Islamic banking are based on the concept of risk-sharing and avoiding interest (riba). This means that instead of charging interest on loans or investments, profits, and losses are shared between the bank and its customers.

7. Education’s Role in Islamic Banking and Finance Evolution:

As the acceptance and prominence of Islamic banking and finance grew globally, the need for specialized education in Islamic banking and finance became more evident. Universities and institutions around the world started introducing tailored courses to cater to this demand.

- A diploma in Islamic Banking became a popular choice for banking professionals seeking to boost their credentials in the sector.

- AIMS in the UK began offering an Islamic Banking MBA Master’s degree program, catering to the increasing demand for executives with a deep understanding of business and Shariah-compliant financial practices.

- AIMS went a step further, providing an opportunity for an online PhD in Islamic Economics and Banking, allowing interested individuals to delve deep into research, further contributing to the evolution and growth of Islamic finance.

These strides in education have been pivotal in molding the evolution and endurance of the history of Islamic banking, which has seen significant growth internationally.

Continuing: Evolution and Development

Islamic banking, with its roots deeply embedded in the principles of Islam, has carved a unique niche for itself in the global financial landscape. The history of Islamic banking and finance is a testament to its resilience, adaptability, and unwavering commitment to ethical and equitable financial practices. This fascinating journey, from the establishment of the first Islamic bank to the widespread acceptance of this alternative financial model, reflects the rich history of Islamic finance. Shows how Islamic banking has successfully bridged the gap between religious principles and economic needs. It has not only promoted sustainable economic growth but has also fostered societal advancements in Muslim societies across the globe.

As we move forward, the evolution of Islamic banking continues, driven by innovative Shariah-compliant financial products and services, and specialized education. The history of Islamic banking and finance indeed highlights a path of continual growth, development, and transformation.