Islamic Finance Products:

Islamic financing is a transformation of Lending into Asset Based Financing, within the ambit of Shariah-compliant Islamic modes of financing, called Islamic Financial Instruments. The Islamic banking institutions first take ownership of the goods, which are being sold or rented. According to a well-known principle of Islamic jurisprudence, “One cannot earn profit from his capital or asset unless he has have taken a risk or liability of ownership of that capital or asset”. Contrary to that, conventional banks earn interest by lending money. Various types of Islamic banking products cater to different needs and preferences. These Islamic finance products are divided into three types: Debt or Trade based products, Equity-Based products, and Semi-debt based.

1. Islamic Banking Products VS Conventional Banking Products:

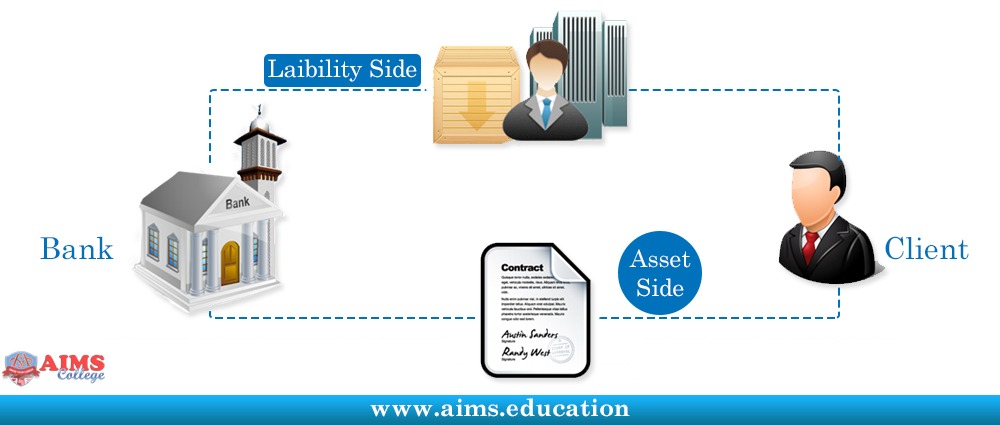

In the case of conventional banking:

- For Asset side products, the bank is the lender, and the client is the borrower.

- For Liability side products, the bank is the borrower, and the client is the lender.

However, the case is different in Islamic banking and financial system, and the asset and liability sides of Islamic banking products are listed below:

| Liability Side Products | Asset Side Products |

|

|

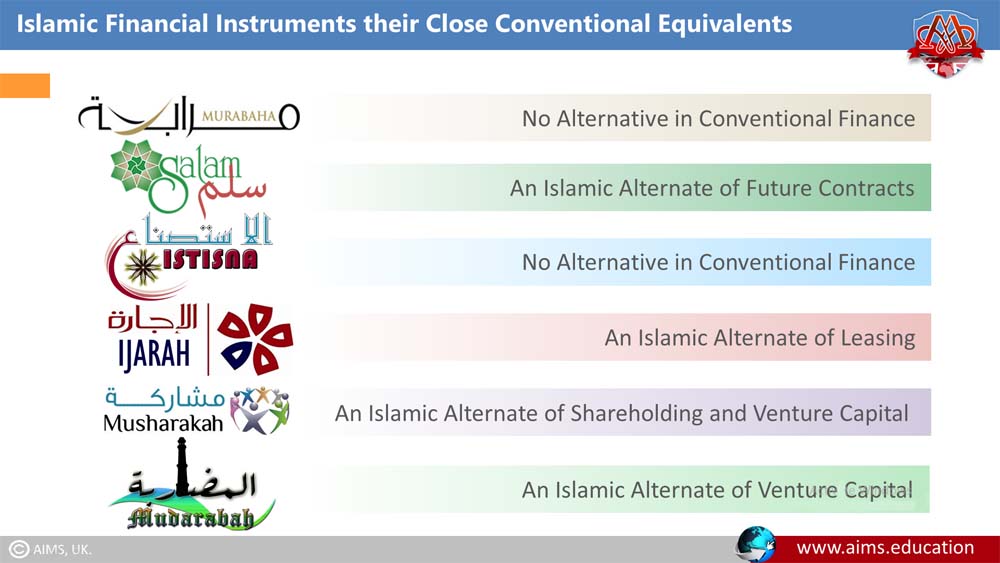

2. Types of Islamic Finance Products

Islamic financial instruments can be broadly classified into three categories: Debt-based or Trade-based products, Equity-based products, and Semi-debt-based products.

A. DEBT-BASED ISLAMIC BANKING PRODUCTS:

Debt-based or Trade-based sharia banking products are financial instruments that are designed to comply with Muslim law, which prohibits the collection and payment of interest. These products are typically based on contracts of exchange. An example of a trade-based product is Murabaha, a cost-plus-profit arrangement where a bank purchases a product and sells it to a customer at a marked-up price, with the customer repaying the bank in installments.

B. EQUITY-BASED ISLAMIC BANKING PRODUCTS:

Equity-based Islamic banking products involve the sharing of profits and losses between the parties involved. They uphold the principle of risk sharing that is central to Islamic finance. An example of an Equity-based product is Musharaka, a joint venture agreement where all partners contribute capital and share in the profits and losses.

C. SEMI-DEBT-BASED ISLAMIC BANKING PRODUCTS:

Semi-debt-based Shairah-compliant financial services are a hybrid of debt-based and equity-based products. These instruments combine elements of both debt and equity financing. An example of a Semi-debt product is Ijarah, a leasing agreement where a bank purchases an asset and leases it to a customer, with the lease payments including a profit margin for the bank. At the end of the lease term, the customer has the option to purchase the asset at a pre-agreed price.

3. Islamic Financial Instruments: A Diverse Spectrum

The realm of Islamic banking products is vast, encompassing diverse financial instruments meticulously designed in adherence to Sharia principles. Institutions such as the International Islamic Banking Institute offer a robust platform to explore and study these products. The institute provides various academic programs, including a Ph.D. thesis in Islamic economics and finance, which dives deep into the complexities of Sharia banking products, and a master’s degree in Islamic banking and finance, offering an in-depth understanding of the Islamic modes of financing.

For those seeking to penetrate the field of Islamic finance without committing to a lengthy academic journey, the institute offers an Islamic banking and finance diploma. Recognized as one of the best Islamic finance qualifications, the CIFE equips students with the knowledge of various types of Sharia-compliant financial services, empowering them to contribute to the growing sector of Islamic banking and finance.

Islamic Modes of Financing: An Overview

Below is an overview of some sharia banking products:

A. MUDARABAH CONTRACT:

In Mudarabah, a unique contract, one party contributes capital while the other brings in effort or expertise. The resulting profits are then divided with strict adherence to a predetermined ratio, instead of a fixed return. Importantly, the investor shoulders any financial losses exclusively.

B. MURABAHAH CONTRACT:

In the context of Murabahah, the goods being sold exist, belong to, and are in the possession of the seller, either physically or constructively. This means the risk of ownership is borne by the seller. The sale of these goods incorporates a profit margin into their selling price. A valid offer and acceptance in a Murabahah transaction ensures clarity on the price, the location of delivery, and the date for the payment of the price.

C. IJARAH CONTRACT:

Ijarah, broadly understood as Islamic lease or rent, represents a crucial mode of finance in Islam. This term signifies the act of offering a service or the benefit of use for a mutually agreed upon price or wage. In this arrangement, the bank provides an asset or equipment—like a plant, office automation equipment, or a motor vehicle—for a predetermined span and rent. Notably, the leased commodity’s ownership stays with the lessor, with only its usufruct transferred to the lessee.

D. MUSHARAKAH CONTRACT:

In a Musharakah business contract, partners establish an agreement to evenly divide business profits and losses. They mutually decide the proportion for profit distribution as outlined in the contract. If any partners decide to take on non-active roles, they can’t receive a profit share exceeding their capital investment ratio.

E. SALAM CONTRACT:

In a Salam contract, the seller commits to delivering specific goods at a predetermined future date. The buyer, in turn, provides full payment at the time of the contract formation. If the buyer does not pay the full amount upfront, it results in a debt-against-debt sale, which is not permissible under Islamic law (Har-aam).

F. ISTISNA CONTRACT:

One of the distinctive Islamic banking products is a contract where the buyer places an order for the manufacturing, assembly, or construction of a specific item. The agreement stipulates a clear price and future delivery date. The item in question needs to be clearly defined in terms of its kind, type, quality, and quantity. The agreed-upon price, unambiguous and absolute, can be paid in a lump sum or in installments, based on mutual agreement.

1. Applications of Islamic Finance Products:

- Murabahah is used for Islamic Trade Finance Transactions, Working Capital Finance, and Fixed Assets Financing.

- Musharakah is used for Working Capital or Running Financing, Term Finance for Joint ventures, and Equity Participation.

- Diminishing Musharakah is used for Asset Financing, such as Cars, Houses, and Shops.

- Ijarah or leasing is used for the financing of Autos, Buildings, Machinery, and Equipment.

- Istisna is used to Finance: Manufacturing Goods, Construction of buildings, Exports, and Pay overhead expenses like salaries and utility bills.

- Salam is used for Agriculture or Commodity financing.

2. Detailed Examination of Types of Islamic Finance Products

Let’s delve deeper into the diverse world of Islamic finance products, and shed light on the mechanics of these Sharia-compliant financial services with concrete examples.

A. SHARIAH COMPLIANT SAVING ACCOUNTS:

Unlike conventional savings accounts that offer interest, Sharia-compliant savings accounts are based on a profit and loss-sharing system. For instance, when a customer deposits money into the account, the bank uses this money for Sharia-compliant investments. The profit from these investments is then shared with the customer.

B. ISLAMIC MORTGAGE/HOME-FINANCING:

In a Sharia-compliant mortgage, the bank purchases the property and sells it back to the customer at a fixed profit. The customer then makes installment payments to the bank. For example, if a customer wants to buy a property worth $250,000, the bank will purchase the property and sell it back to the customer for $300,000 to be paid in installments over a predefined period.

C. INVESTMENT ACCOUNTS BASED ON PROFIT AND LOSS SHARING:

An example of this type of account is the Mudarabah account. In this arrangement, the customer provides capital, and the bank manages the business activity. The profits are shared between both parties according to a pre-agreed ratio, but the losses are borne only by the customer.

D. TAKAFUL (Islamic Insurance):

Takaful operates on the principle of mutual cooperation. Participants contribute to a fund, which is then used to compensate any member who suffers a loss. For instance, in a Takaful car insurance policy, all policyholders contribute to a pool, and in the event of an accident, the necessary amount is taken from the shared pool to cover the loss.

By understanding the intricacies of these Islamic banking and finance products, it’s clear they offer a unique and ethical alternative to conventional banking and finance mechanisms. Each product aligns financial needs with religious principles, creating a harmonious balance between worldly transactions and spiritual beliefs.

3. Future of Shariah Banking Products

The landscape of Islamic finance is on the cusp of significant transformation. As the demand for Shariah-compliant banking products grows, the industry is poised to benefit from advancements in financial technology and the growing consciousness towards ethical investing. Innovative Islamic financial instruments are expected to emerge, promoting greater inclusivity and diversity in financial services, with technology playing a pivotal role in this evolution.

HARNESSING BLOCKCHAIN AND ARTIFICIAL INTELLIGENCE IN ISLAMIC BANKING:

Blockchain and artificial intelligence, for example, hold great potential to streamline operations, improve efficiency, and enhance customer experience in Islamic banking. Further, the incorporation of ESG (Environmental, Social, and Governance) principles into Islamic banking can resonate with the wider ethical finance movement, potentially drawing new demographics towards Islamic finance. Therefore, the future of Shariah banking products seems bright and full of opportunities, as long as they continue to innovate and adapt to the changing dynamics of the financial world and the communities they serve.

4. Exploring the World of Sharia-Compliant Financial Services

As you can see, Islamic banking and finance products provide an alternative model for financial services that align with Islamic principles. From various types of banking products to different modes of financing, individuals and businesses have a range of options to choose from. With its focus on ethical and socially responsible investments, Islamic finance continues to grow in popularity globally as more people recognize its benefits. So next time you consider your financial options, be sure to explore the world of Sharia-compliant financial services and see how they can benefit you.