Risk Management in Islamic Finance:

Managing risks is an essential aspect of any banking or financial institution, and the same goes for Islamic banking and finance. As the industry continues to grow, understanding risk and its management is crucial for its sustainability and success. Risk management in Islamic finance can be defined as forecasting financial risks and applying necessary procedures to minimize their impact while practicing Islamic Finance, Banking, and Takaful. Risk management in Islamic banking and finance is anchored by fifteen fundamental principles that guide the business goals that may be adopted by institutions operating in the realm of Shariah finance. These principles are categorized into six distinct types, including Credit Risk, Equity Investment Risk, Market Risk, Liquidity Risk, and Operational Risk.

Principles & Types of Risk in Islamic Banking:

A. Credit Risk in Islamic Banking:

Credit risk includes the risk arising in the settlement and clearing transactions. It is defined as the “Potential that counterparty fails to meet its obligations, per agreed terms”. Credit risk applies to:

- Institutions have financing exposures to receivables and leases. For Example: Murabahah, Diminishing Musharakah, and Ijarah; and;

- Institutions that are managing the working capital financing transactions, and projects. For Example Salam, Istisna, or Mudharbah.

Here are the principles for minimizing the “Credit Risk”:

PRINCIPLE # 1

For effective risk management in Islamic banking, institutions shall have a comprehensive risk management and reporting process. The process shall take into account, appropriate steps to comply with Shariah rules and principles, and ensure reporting to the supervisory authority.

PRINCIPLE # 2

Institutions shall have a strategy for financing, using various Shariah-compliant instruments, to recognize potential credit exposures, which may arise at different stages of various financing agreements.

PRINCIPLE # 3

Institutions shall carry out a due diligence review, before deciding on an appropriate Islamic financing instrument.

PRINCIPLE # 4

Institutions shall have an appropriate methodology, to measure and report possible credit risk under each Islamic financing instrument for ideal risk management in Islamic banking.

PRINCIPLE # 5

Institutions shall have Shariah-compliant credit risk-mitigating techniques for each Islamic banking and takaful instrument. These techniques must include the following:

- Methodology for setting mark-up rates according to the risk rating, where expected risks should be taken for pricing decisions;

- Permissible and enforceable collateral and guarantees;

- Clear documentation as to, whether or not, purchase orders are cancelable; and;

- Clear procedures for governing laws for financing transactions.

B. Equity Investment Risk in Islamic Banking and Finance:

It is the risk arising from entering into a partnership, to participate in a particular financing, in which the investor shares in the business risk. Here are the principles to minimize Equity Investment Risk:

PRINCIPLE # 6

Islamic financial institutions shall have appropriate risk management, and reporting processes, for risk characteristics of equity investments.

PRINCIPLE # 7

For security risk management in Islamic finance, Islamic banking and takaful Institutions shall ensure that their valuation methodologies are appropriate and consistent, and shall assess the potential impacts of their methods on profit calculations and allocations.

PRINCIPLE # 8

For an ideal Shariah-compliant risk management in Islamic finance, institutions shall establish the exit strategies, in respect of their equity investment activities, subject to the approval of the institution’s Shariah Advisor.

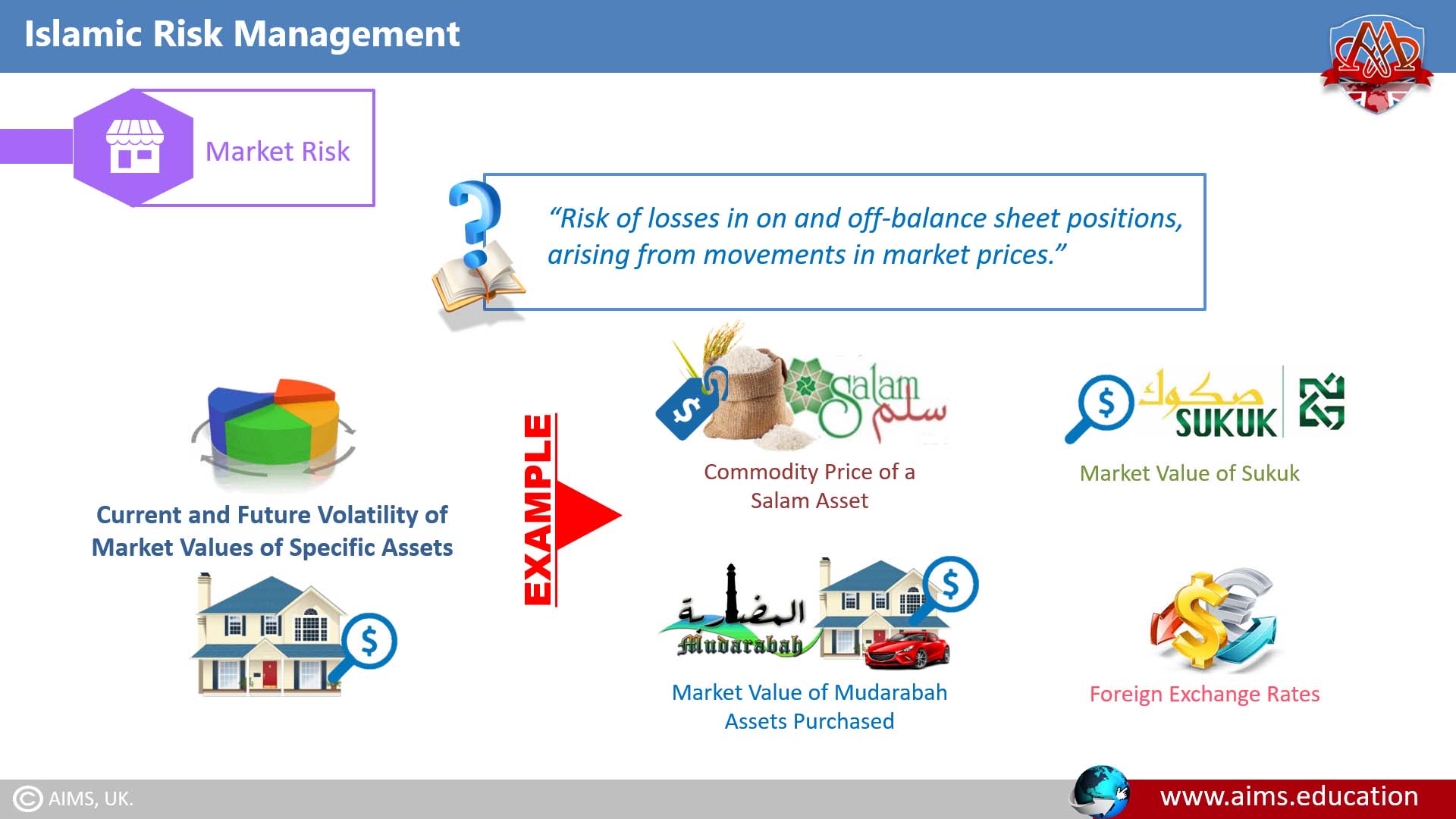

C. Market Risk in Islamic Banking:

It is defined as the “Risk of losses in on and off-balance sheet positions, arising from movements in market prices”. It is related to the current and future volatility of market values of specific assets. For Example:

- Commodity price of a Salam asset;

- The market value of Sukuk;

- The market value of Mudharbah assets purchased; and;

- Foreign exchange rates.

Here is the principle to minimize the “Market Risk”:

PRINCIPLE # 9

Institutions shall have an appropriate framework for market risk management, including reporting of all assets held.

D. Liquidity Risk in Islamic Finance:

It is the potential loss to Islamic financial Institutions, arising from their inability, either to meet their obligations or to fund increases in assets. Here are the principles for minimizing “Liquidity Risk”:

PRINCIPLE # 10

Institutions shall have a liquidity management framework, including reporting taken into account separately, and liquidity on an overall basis.

PRINCIPLE # 11

Institutions shall assume liquidity risk, commensurate with their ability to have sufficient recourse to halal investment funds.

E. Rate of Return Risk in Islamic Finance:

Institutions are exposed to this risk on their overall balance sheet exposures. The rate of return risk differs from interest rate risk, as institutions are concerned with the result of their investment activities, at the end of the investment-holding period. Such results cannot be pre-determined exactly.

Here are the principles to minimize the “Rate of Return Risk in Islamic finance”:

PRINCIPLE # 12

Institutions shall establish a reporting process to assess market factors, that affect rates of return on assets, in comparison with the expected rates of return for PLS deposit holders.

PRINCIPLE # 13

Institutions shall have an appropriate framework for managing displaced commercial risk, where applicable.

F. Operation Risk in Islamic Banking and Finance:

They arise due to processes, people, and systems; and reputational risk arises due to failures in governance, business strategy, and process. To counter them, institutions should ensure the soundness of operations and reliability of reporting. The last two principles are about minimizing the operational risk in Islamic banking:

PRINCIPLE # 14

Institutions shall ensure adequate systems and controls, including compliance with Shariah rules and principles.

PRINCIPLE # 15

Institutions shall have appropriate mechanisms to safeguard the interests of all fund providers. Especially for PLS deposit holder’s funds, institutions shall ensure that bases for the asset, revenue, expense, and profit allocations are applied and reported properly.

Risks in Different Islamic Modes of Financing:

By understanding these risks in different Islamic modes of financing, Islamic financial institutions can develop better risk management strategies to mitigate them effectively.

1. Murabaha (Cost-Plus Financing) Risk:

The primary risk in Murabaha financing is credit risk, as the bank relies heavily on the customer’s willingness and ability to pay back the debt.

2. Musharakah (Joint Venture) Risk:

This mode introduces partnership risk, where potential losses must be shared according to the proportion of capital contributed by each partner.

3. Ijarah (Leasing) Risk:

This involves asset risk, as the bank must manage, maintain, and bear the cost of the asset throughout the lease period.

4. Salam (Deferred Delivery) Risk:

In Salam contracts, the risk lies in the delivery and quality of the commodity, since the payment is made upfront with delayed delivery.

5. Istisna (Manufacturing Contract) Risk:

The primary risk in Istisna comes from potential delays or defects in the manufacturing process, which can lead to non-compliance with the agreed-upon specifications.

6. Sukuk (Islamic Bonds) Risk:

Risks associated with Sukuk include market risk, credit risk, and potential non-compliance with Shari’ah principles.

Reporting Process for Risk Management in Islamic Banking and Finance:

The comprehensive reporting process and risk management in Islamic banking include meticulous board and senior management oversight. The aim is to identify, measure, monitor, report, and control the relevant categories of risks involved. The process must ensure compliance with Shariah rules and principles, and it should also involve the adequate reporting of risk management in Islamic banking to the supervisory authority.

1. Role of the Board of Directors (BOD) in Risk Management:

The risk management activities of Islamic Banking Institutions (IBIs) necessitate active oversight by the Board of Directors (BOD) and senior management. The BOD is responsible for approving the objectives of risk management in Islamic banking, along with the strategies, policies, and procedures. These must align with the institution’s financial condition, risk profile, and risk tolerance levels. The BOD must ensure an effective risk management structure is in place, which includes adequate systems for measuring, monitoring, reporting, and controlling risk exposures.

2. Shariah Compliance in Islamic Banking:

To ensure adequate risk management in Islamic banking, every IBI should have a Shariah Advisor, in line with sound corporate governance principles and the central bank’s Fit and Proper Criteria for Shariah Advisors. The advisor is responsible for overseeing the compliance of the bank’s products and activities with Shariah rules and principles as advised by the central bank and the Shariah Advisor.

3. Risk Limitations and Capital Allocation:

The BOD must approve limits on aggregate financing and investment exposures to avoid risk concentration. IBIs must maintain adequate capital against these exposures. The effectiveness of the periodic activities of risk management in Islamic finance should be under constant review by the BOD, with necessary changes made as required.

4. Role of Senior Management in Risk Management:

Senior management must execute the strategic direction set by the BOD and establish clear lines of authority and responsibility for managing, monitoring, and reporting risks. The financing and investment activities must be within the approved limits. The functions for risk management in Islamic banking should be separated from the risk-taking function and should report directly to the BOD or senior management.

5. Independent Risk Management Unit:

Depending on the scope, size, and complexity of an IBI’s business activities, the risk management function should be carried out by personnel from an independent unit of risk management in Islamic banking. This unit is responsible for defining policies, establishing procedures, monitoring compliance with the established limits, and reporting to top management on risk matters accordingly.

Execution of Risk Management in Finance:

- Islamic banking system shall have a sound process for executing all elements of risk management, including risk identification, measurement, mitigation, monitoring, reporting, and control. This process requires the implementation of appropriate policies, limits, procedures, and effective management.

- Information systems (MIS) for internal risk reporting and decision-making that are commensurate with the scope, complexity, and nature of IBIs’ activities.

- IBIs shall ensure that an adequate system of controls with appropriate checks and balances is in place. The controls shall: (a) comply with the Shariah rules and principles; (b) comply with applicable regulatory and internal policies and procedures; and (c) take into account the integrity of processes of risk management in Islamic banking.

- IBIs shall make appropriate and timely disclosure of information to depositors having deposits on a Profit and Loss Sharing basis, minimum requirements of which are specified by CENTRAL BANK in its Guidelines for Shariah Compliance in IBIs” so that they can assess the potential risks and rewards of their deposits and to protect their interests in their decision-making process.

1. Emergency and Contingency Plan for Risks:

The senior management must actively develop an emergency and contingency plan. The board of directors must approve this plan, designed to address risks and challenges that could emerge from unexpected events.

2. Integration of Risk Management:

When it comes to risk assessment and management, it’s imperative that the management adopts a holistic view of the risks that institutions are exposed to. This necessitates the establishment of a structure that scrutinizes the interconnections of risk management within Islamic banking across the entire organization. This structure could manifest as a distinct department or could take the form of the bank’s Risk Management Committee. Regardless of its form, the structure must guarantee thorough monitoring and control over the risks undertaken.

3. Risk Measurement:

For each category of risk, IBIs are encouraged to establish systems/models that quantify the profile of better risk management in Islamic finance. The results of these models should be assessed by an independent risk review function.

4. Human Resource:

Human Resources (HR) plays a pivotal role in risk management within an Islamic Banking Institute (IBI). The HR department must ensure that its workforce is well-equipped and competent in dealing with various aspects of risk management in Islamic banking and finance. This can be achieved through rigorous training programs and continuous professional development. AIMS’ online Islamic banking and finance courses are increasingly popular, providing a flexible and comprehensive curriculum. Employees seeking to gain in-depth knowledge and expertise can pursue the best certificate in Islamic finance or even an Islamic banking diploma online. For those aiming for more advanced knowledge, Masters in Islamic finance online and PhD in Islamic finance and economics are available.

Future of Risk Management in Islamic Banking:

Risk management in Islamic banking and finance is vital for institutions to safeguard against potential risks and maintain stability in the industry. By implementing robust risk management processes and adhering to Shari’ah principles, institutions can ensure sustainable growth and success in the long run. Ongoing training, regular audits, proper documentation, and collaboration are key elements that contribute to effective risk management in this sector. So, it is crucial for institutions operating in Islamic banking and finance to prioritize risk management and continuously improve their practices to mitigate potential risks and maintain overall industry stability.

Remember, risk cannot be completely eliminated, but with proper risk management strategies in place, institutions can minimize their impact and thrive in this fast-growing industry. With the support of regulatory bodies and collaboration among industry players, the future of risk management in Islamic banking and finance looks promising.