Wakala Meaning:

Wakala “وَكَالَة” refers to a contract where a principal (or muwakkil) authorizes or appoints an agent (or wakeel), to act and make decisions on behalf of the principal. Wakala meaning is “Contract of an Agency”. The wakalah contract is about the provision of service, and the main features of wakalah are service, representation, and power to affect the legal position of the principal. Wakalah in Islamic banking refers to a contract in which a depositor (principal) appoints a bank (agent) to carry out a specific task on their behalf.

Wakala Contract

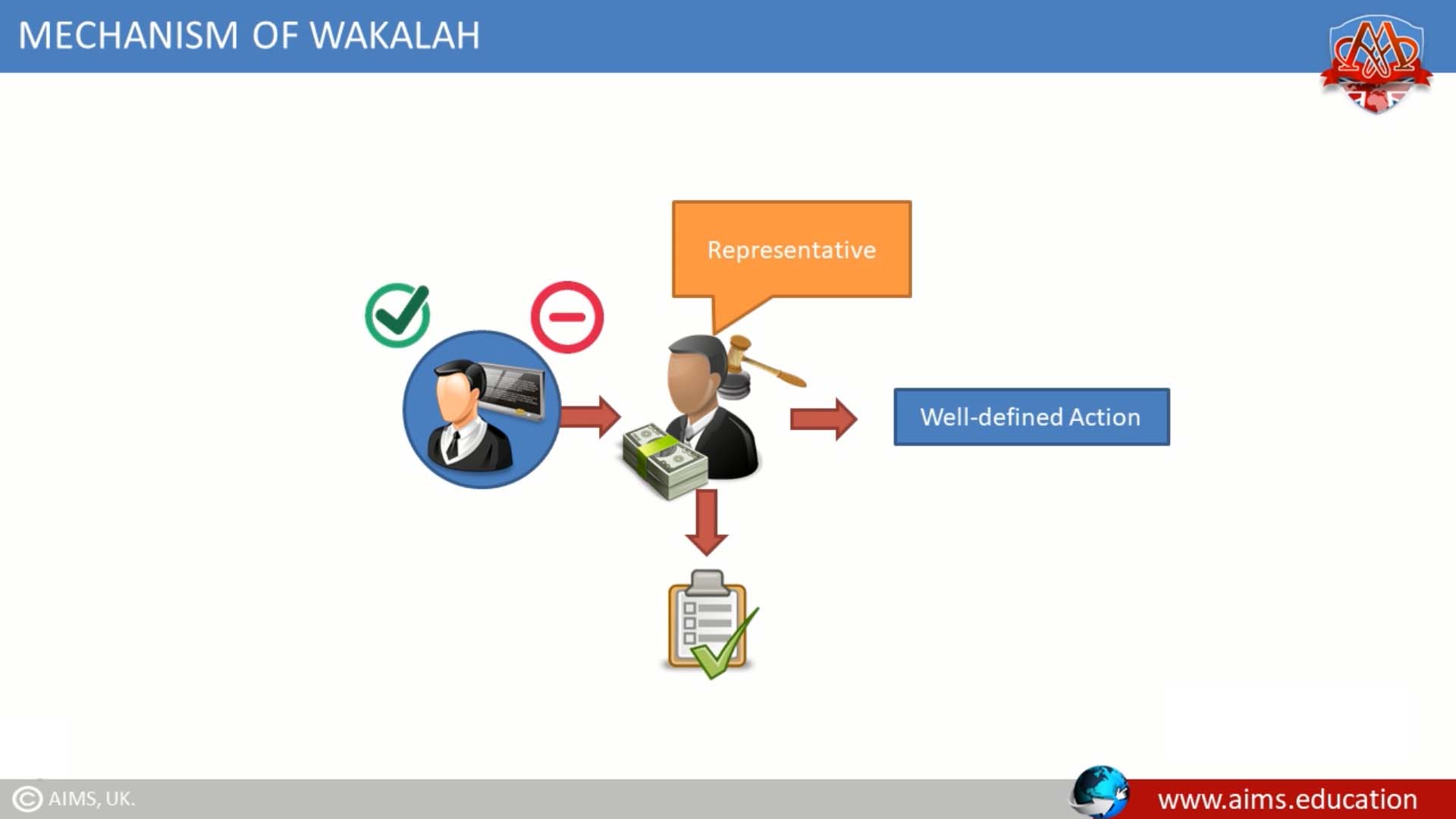

1. What is Wakalah Contract?

- The principal appoints an agent on behalf of himself, to carry out a certain well-defined action, as a representative.

- The tasks are performed by the agent, according to the instructions.

- The agent is entitled to receive a predetermined fee, irrespective of whether the accomplished task satisfied the principal or not.

2. Conditions in Wakala

- The agent should also be a competent person.

- Principals should have the power, and competence to deal. For example, an insane or a minor cannot appoint agents.

- The task at hand must be explicitly defined and must comply with legal and ethical standards.

3. Types of Wakalah Agreement:

a. PARTICULAR WAKALAHOR SPECIAL AGENCY:

The agency contract is made for a certain known transaction. Example: An Agent is bound to sell or buy a particular house or car.

b. GENERAL WAKALAH:

It is a general delegation of power. For example, the Principal asks an agent to buy a 4-bedroom house.

c. RESTRICTED AGENCY:

Where the agent acts within certain conditions. Example: Buying the house at a certain price, and on in a given time.

d. ABSOLUTE AGENCY:

Where no condition is put for the transaction. For example, no specific price or time is given to the agent.

4. Example of Wakala: Role of Representatives

- In the legal realm, attorneys are engaged to advocate for their clients’ interests, articulating their needs in a judicial environment.

- On a similar note, brokers are commissioned to facilitate transactions involving goods, either by procuring or vending them as needed.

- Furthermore, within corporate structures, key roles like managers and directors are essential, executing responsibilities on behalf of the organization.

5. The Importance of Wakeel/Agents in Commerce:

In certain instances, the expertise of specialized intermediaries is vital. These intermediaries draft contracts on their principals’ behalf or manage their principals’ assets. The world of commerce could face significant setbacks if business professionals and traders were not permitted to utilize agents’ services and were compelled to handle all tasks independently.

6. Compensation of Agents in Wakala

An agent working under the purview of wakala may receive a stipulated salary for their services. In scenarios where the remuneration is not explicitly delineated, customary practices prevail. As an illustration, legal professionals or brokers are entitled to their fees as per the norms ubiquitously accepted. It is crucial to note that wakalah is a non-binding contract.

Wakalah in Islamic Banking:

Wakala in Islamic banking is used, where a representative is appointed to undertake transactions on another person’s behalf. The agency law or Wakala law is to facilitate economic exchanges, where they are hindered by distance, size, and numbers, or where the principal is unable, or unwilling to act personally.

1. The Role of Wakala in Islamic Banking Operations

Wakala is a pivotal mechanism in Islamic Banking, contributing extensively to its operational efficacy. The fundamental principle of Wakala is the transfer of authorized power from the ‘muwakkil’ (principal) to the ‘wakil’ (agent). In the context of Islamic Banks, the bank is typically appointed as the wakil. The bank, acting as the wakil, is granted the authority to conduct various financial transactions on behalf of the muwakkil (depositor). This includes, but is not restricted to, lending money, managing investments, and facilitating purchases.

2. Wakala Deposit:

Wakala deposit is generally referred to as a Shariah Compliant contract in which the customer authorizes an Islamic bank to invest his/her funds in Shariah-approved activities to earn profits. In this case, the depositor acts as the principal and appoints the bank as their agent to invest their funds in a Shariah-compliant manner. The bank is responsible for managing the investment and providing annual profit or loss reports to the depositor.

3. Pathways to Deeper Understanding of Wakala

For individuals and companies interested in delving deeper into the complexities of Islamic banking and financial mechanisms such as Wakala, there are several routes of academic and professional development available. The CIFE is a globally recognized Islamic finance certification that introduces candidates to the fundamental principles and applications of Islamic finance.

For those seeking advanced knowledge and research capabilities, pursuing an affordable Masters in Islamic finance or even an Islamic banking and finance PhD can offer a comprehensive exploration of complex financial structures, in the context of global financial markets. These in-depth programs, by providing a blend of theoretical and practical insights, equip students with the necessary skills to navigate and contribute to the continually evolving landscape of Islamic banking and finance.

Shariah Laws Concerning Wakala (وَكَالَة):

Wakala refers to the concept of a businessman entrusting another to act in his stead or as his representative. It has been a long-standing custom to appoint an agent to facilitate trade operations. Wakala is the most important element in Islamic partnerships, and in modern law too, the relationship between partners is known as a principal-agent relationship.

The main Shariah laws concerning an agency are as follows:

1. The Appointment of an Agent: Proposal and Acceptance

The essence of the appointment of an agent lies in the proposal and acceptance of the position, which is fundamentally different from sending a messenger. The appointing person permits the agent to act on their behalf, but this is not akin to the role of a messenger.

2. Legal Competency and Understanding in Agent Appointment

In وَكَالَة, a person who appoints an agent must demonstrate legal competency to initiate the tasks for which the agent is appointed. This excludes certain groups such as the insane or infants. Although the appointing person need not have attained legal age, understanding and sound judgment are essential.

3. Scope of an Agent’s Authority in Business Transactions

An agent can be appointed to conduct any business transaction that the principal is capable of executing personally. This includes contracts concerning gifts, loans for gratuitous use, or deposits, as well as entering into partnerships or settling disagreements.

4. Role of Agent as Custodian and Trustee

An agent appointed to buy and sell or pay and receive debts is viewed as a custodian of the principal’s property and operates in a trustee’s capacity. If the property is destroyed without fault or negligence on their part, they are not liable for compensation.

5. Entitlement of Agent to Remuneration

An agent’s right to receive remuneration is predicated on a prior contractual agreement. In the absence of such an agreement, the agent is not entitled to remuneration.

6. Conflict of Interest: Agent Buying Principal’s Goods

It is strictly prohibited for an agent appointed to sell goods to buy them for personal use without the principal’s explicit consent.

7. Discretion of Agent with Selling Goods

Unless given contrary instructions, an agent tasked with selling goods has the discretion to sell them for cash or on credit. They can also secure a pledge or surety for the price of goods sold on credit. However, the agent cannot be held responsible if the pledge is destroyed or if the surety becomes bankrupt.

8. Dismissal of the Agent

The principal retains the right to dismiss the agent, as long as this does not infringe upon the rights of others.

9. Discharge of the Agent upon Principal’s Death

An agent’s role is considered terminated upon the principal’s death unless this contravenes other parties’ rights.

10. Impact of Principal’s Mental Health on the Agency

The agency agreement becomes void if the principal becomes a lunatic, rendering them incapable of overseeing the tasks assigned to the agent.

Conclusion

In conclusion, وَكَالَة or Wakala is an integral part of Islamic banking and finance, fundamentally a trustee relationship between two parties: the principal and the agent.

- The agent acts in the best interest of the principal, with specific guidelines on remuneration, potential conflict of interest, selling goods, and terms of dismissal.

- The agency is significantly influenced by the principal’s mental health.

- The death of the principal or a shift to their mental state rendering them incapable of overseeing tasks leads to the termination of the agency.

Understanding the “wakala meaning” reinforces how critical it is for both parties to engage in transparent and just financial dealings. The concept of a Wakalah contract highlights the importance of thorough comprehension and ethical behavior in these arrangements.